how to get amazon flex tax form

If you are a US. Stack Amazon Flex with other delivery apps.

Amazon Flex Debit Card How To Apply For And Use The Card

As a self-employed independent contractor you will have to pay taxes and self-employment tax on your.

. If you made less than 600 you usually wont get a 1099 for Amazon Flex income. Log in to Amazon Associates. Gig Economy Masters Course.

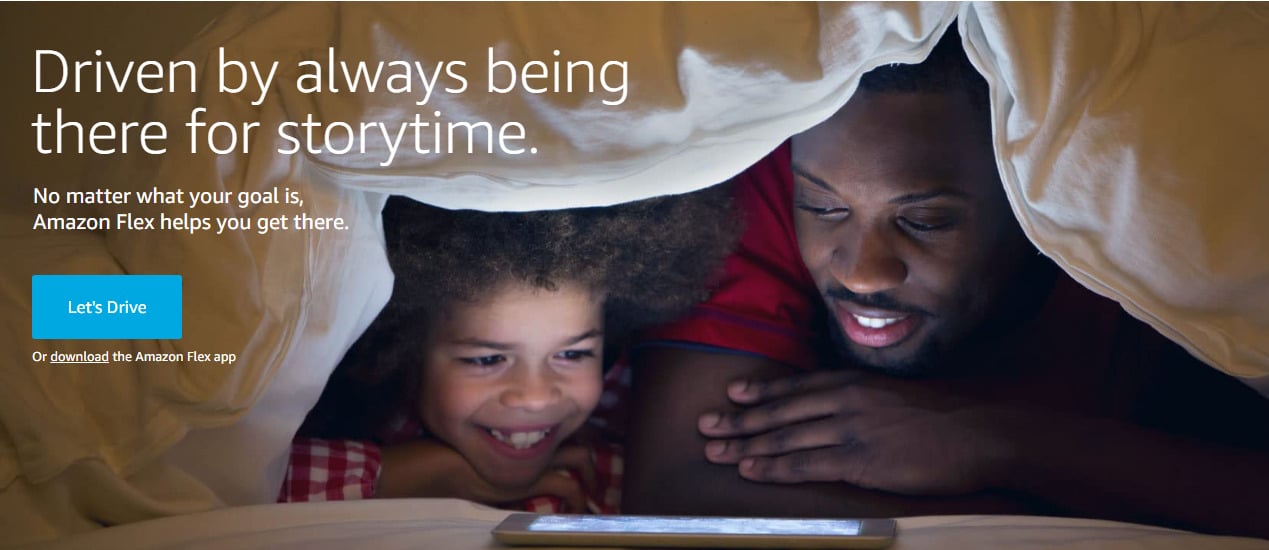

Hover over your email address displayed in the top right corner and select Account Settings. Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals. We issue Form 1099-MISC on or before January 31 each year or the following business day if January 31 falls on a weekend or legal holiday.

Keep track of what you spend on Amazon Flex. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after. Royalty or rent income by participating in one or more Amazon programs you.

Increase Your Earnings. Keep your app updated to the latest version. The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or.

Want to deliver for Amazon Flex. Payee and earn income reportable on Form 1099-MISC eg. Will I also get a 1099-MISC form.

Amazon Flex will not withhold income tax or file my taxes for me. So if you drive for Amazon Flex and are unclear about your taxpayer status or responsibilities -- and how the 1099 form figures into it all -- the following information should answer a few. Turn to podcasts for company.

600 is the IRS minimum and it costs Amazon money to send tax forms. Get all your questions answered from how to start earning with Flex how to earn more through our rewards program and more. To access a digital copy of your form please follow these steps.

When will I get my tax forms.

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Filing Tax Returns For Delivery Drivers Tips And Advice Turbotax Tax Tips Videos

Flex Tax Remote Flex Tax Remote Gives You Help And Guidance From Credentialed Tax Experts So You Can File With An Extra Level Of Confidence Save More Get Started By

What It S Like To Be An Amazon Flex Delivery Driver

Amazon Flex Q A For 2021 Youtube

How To File Amazon Flex 1099 Taxes The Easy Way

7 Ways To Make More As An Amazon Flex Driver

Where To Find Amazon Flex 1099 Form Rideshare Dashboard

Tax Forms Email R Amazonflexdrivers

Becoming Amazon Flex Driver How To Pros And Cons Salary

7 Ways To Make More As An Amazon Flex Driver

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Becoming Amazon Flex Driver How To Pros And Cons Salary

Amazon Seller Income Tax And Sales Tax Reporting The Ultimate Guide